The National Golf Foundation’s Graffis Report, a holistic overview of an unprecedented year in the golf industry, is now available for NGF members. The Graffis Report compiles many of the game’s key 2020 data points on the business of golf and the health of the game in a single publication: golf participation, engagement, rounds-played, golf course supply and development, golf equipment sales, retail supply and the game’s reach.

The full report, named after Herb and Joe Graffis, who founded NGF 85 years ago as the first golf business research, education and trade organization, can be accessed here.

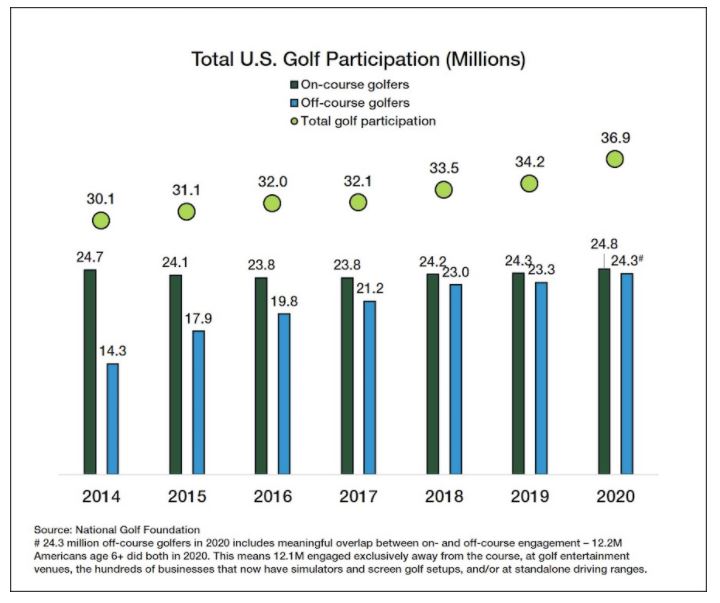

Coming into 2020, there was plenty of optimism for the U.S. golf industry, thanks to stable green grass participation and significant growth of engagement away from the course. Then the world was struck by the coronavirus pandemic and golf, like most other businesses, took a huge hit. But spring shutdowns gave way to an unprecedented summer and fall in terms of play, golfer introductions and reintroductions, and robust, late-season spending. Looking back on an unprecedented year, several things stand out:

- 14% year-over-year increase in rounds despite March/April course shutdowns

- Total golf participation (on/off-course combined) up 8% Y.O.Y. to 36.9 million participants

- Net gain of 500K on-course golfers, the largest lift in 17 years, up to 24.8M

- An increasing number of interested green grass prospects, up 10% Y.O.Y.

- Significant decrease in the number of course closures as the financial health of facilities nationwide has improved

Surges in play got the most attention in 2020, and rightfully so. Consider that the average weather-related fluctuation is +/- 2%-3% in a typical year and only once in the past two decades was there a 5% Y.O.Y. increase. The 14% jump means that, even with the loss of 20 million spring rounds, the net gain over 2019 was in the neighborhood of 60 million rounds, putting the industry around 500M in total. Heightened demand was particularly evident from June through year’s end, when approximately 75M more rounds were played than the same stretch in 2019.

When NGF began tracking off-course forms of golf some years back, it was to better quantify the game’s broader consumer base and footprint. This goes well beyond Topgolf – to other golf entertainment venues, and the hundreds of businesses that now have simulators and screen golf setups, plus the good old standalone driving ranges, which believe it or not still outnumber Costco warehouses.

Today, almost as many people engage with off-course forms of golf as do traditional “green-grass,” with considerable overlap between the two. Over the past five years, the overall golf consumer pool has risen 19% to 36.9M – including now 12.1M Americans who only hit golf balls with golf clubs somewhere away from the course.

Meanwhile, the number of active, on-course golfers in the U.S. grew by half a million in 2020, up to 24.8 million. It was the most significant Y.O.Y. net increase since 2003, thanks to a record inflow of beginning and returning players (6.2M of them, which is 27% higher than the year before and almost enough to populate Los Angeles and Houston). The net gain could have been even greater, but 2020 was an extraordinary year in more ways than one. Last year 5.7M people stepped away from the game, a 19% increase in outflow versus the year before. The incremental loss was marked by virus anxieties, financial hardships, parenting challenges, and the cancellation of thousands of charity and/or corporate events that draw in “occasional” golfers. Lucky for us, the recently-lapsed participants in 2020 show significantly more interest in returning compared to recently-lapsed in years past.

Speaking of interest, golf’s pipeline of green grass prospects, which we refer to more clinically as “latent demand,” has never been bigger. The number of Americans who didn’t play on a course in the past year but suggest they’re “very interested” in doing so now rose to 17M in 2020 – a 10% increase from the year before and up more than 40% since 2015. As interest continues to swell, there’s been a concomitant rise in the number of beginners, which this year hit an all-time high.

On the supply side, the number of golf course closures dropped significantly (-31%) compared to prior year. NGF recorded a total of 193 18-hole equivalent closures in 2020, about 1.3% of total supply. Demand for land to develop into residential and commercial real estate projects continues to fuel the supply correction in golf. At the same time, fewer than 8% of the nation’s 14,000+ facilities report that they are in poor financial shape, down from 25% in 2016. Markets are always adjusting, but last year’s downswing in closures and improvements in facility financial health could signal the beginning of the end of golf’s ongoing demand/supply correction, which has lingered for 15 years.

Again, members can download a copy of the full Graffis Report at the NGF website. For more information about joining the NGF’s growing community of golf courses, businesses and organizations, please visit https://www.ngf.org/membership/ or contact Sandi Williams at (561) 354-1617. Member dues, which start at $250 annually, help fund the research and services NGF provides for the industry.