Callaway Golf Company Announces 22% Increase in Sales and a 30% Increase in Earnings For The First Quarter Of 2014; Reiterates Financial Guidance

Callaway Golf Company Announces 22% Increase in Sales and a 30% Increase in Earnings For The First Quarter Of 2014; Reiterates Financial Guidance

- 2014 first quarter sales increased 22% to $352 million, compared to $288 million in 2013.

- 2014 first quarter income from operations increased 54% to $62 million, compared to $40 million in 2013.

- 2014 first quarter earnings per share increased 30% to $0.61, compared to $0.47 in 2013.

- Callaway reiterates full year 2014 earnings guidance, estimating sales of $880 million to $900 million and fully diluted earnings per share of $0.12 to $0.16.

Callaway Golf Company (NYSE:ELY) has announced its first quarter 2014 financial results, including a 22% increase in sales driven by double digit growth in woods (+33%), irons (+29%), and golf balls (+24%).

Additionally, income from operations increased 54% to $62 million and fully diluted earnings per share increased 30% to $0.61, both driven by the increased sales and improvements in gross margins of 160 basis points, which more than offset an increase of $13 million in operating expenses and a $9 million decrease in other income.

The 2014 results benefitted from a $4 million decrease in pre-tax charges related to the cost reduction initiatives that were completed in 2013. The Company was able to achieve these significantly improved financial results despite adverse changes in foreign currency rates, which negatively impacted 2014 sales by $6 million, a $9 million dollar decrease in other income/expense resulting primarily from adverse changes in foreign currency contract values, and a $4 million increase in stock compensation expense as a result of increases in the Company’s stock price.

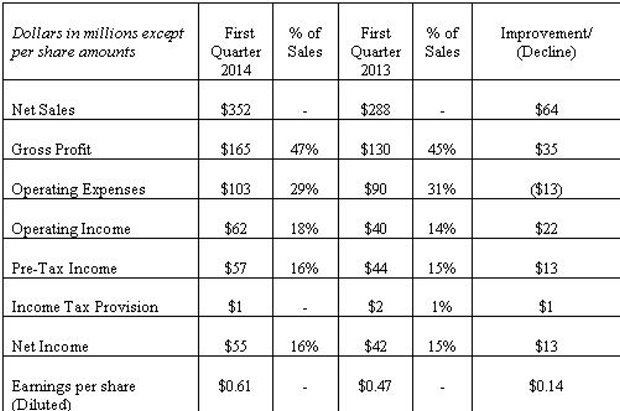

GAAP RESULTS

For the first quarter of 2014, the Company reported the following results, as compared to the same period in 2013:

The Company’s net sales for the first quarter of 2014 increased to $352 million or up 22%, as compared to $288 million for the same period in 2013. The strength of the Company’s 2014 product line more than offset the negative impact of foreign currency movements. As compared to 2013, the Company’s first quarter 2014 net sales were negatively impacted by $6 million due to adverse changes in foreign currency exchange rates.

In addition to the increase in sales, gross margins improved 160 basis points compared to last year due to improved pricing and sales mix, the completion of the cost-reduction initiatives in 2013, and productivity improvements resulting from several initiatives implemented last year, all of which more than offset the negative impact of foreign currency exchange rates and increased product costs associated with additional technology in several new products.

Operating expenses increased $13 million due to increases in marketing support for new products launched during the quarter, an increase in stock compensation expense associated with a 54% increase in the stock price compared to March 31, 2013, and planned incremental tour investment.

Other income/expense decreased by $9 million to other expense of $5 million in the first quarter of 2014 compared to other income of $4 million in the first quarter of 2013. This decrease is primarily attributable to changes in foreign currency contract valuations. These contracts, which are used to hedge the Company’s exposure to changes in foreign currency exchange rates, are required to be marked to market at the end of each quarter and changes in the contract values are reported in other income/expense. The Company recorded contract valuation losses of $3 million in the first quarter of 2014 compared to $8 million of contract valuation gains in the first quarter of 2013.

As a result of the increase in net sales and improved gross margins, which more than offset the increase in operating expenses and foreign currency contract losses, earnings per share for the first quarter of 2014 increased 30% to $0.61 compared to $0.47 in 2013.

“We are pleased with our results for the first quarter,” commented Chip Brewer, President and Chief Executive Officer. “These results reflect our continued brand momentum and the success of the first stage of our multi-year turnaround plan. In particular, our renewed focus on more consumer-oriented products has resulted in double digit sales increases in our woods, irons and golf ball product categories, resulting in a 22% increase in net sales for the quarter and market share gains in each of our key markets around the world.”

“As evidenced by our recent results, we are now clearly seeing the benefits of the many changes we have made at the Company as part of our turnaround plan,” continued Mr. Brewer. “We believe that our turnaround plan is firmly on track and that we are laying the proper foundation for a sustained recovery over the long-term. With that said, in the short term, we are anticipating very challenging market conditions for the second quarter and possibly the balance of the year. The golf market has been slow to open in many regions where we conduct business, including our largest region, the United States, which continues to have unfavorable weather in many parts of the country. In addition, overall retail inventory levels are high and we anticipate a heavy promotional environment while the industry works through the excess inventory. We are maintaining our full year guidance, but if the golf market does not open shortly or the promotional activity is heavier than we anticipate, we would expect to be at the low end of our earnings guidance.”

Business Outlook for 2014

Second Quarter

The Company has reported that it expects challenging market conditions in the second quarter because of a late start to the 2014 golf season as well as high retail inventory levels and anticipated promotional activity. Due to these conditions, as well as the successful retail sell-in during the first quarter, the Company estimates for the second quarter of 2014 (compared to the second quarter of 2013) that its sales will be flat to down 5% percent and that its earnings per share will be breakeven to slightly profitable.

Full Year

The Company is maintaining its financial guidance for the full year 2014, but notes that if the golf market does not open shortly or if promotional activity is heavier than anticipated the Company would expect to be at the low end of the earnings guidance. The guidance previously provided is as follows:

- Net sales for the full year 2014 are estimated to range from $880 to $900 million, compared to $843 million in 2013. The Company believes this growth rate will exceed the overall market and be driven by brand momentum and market share gains.

- Gross margins are estimated to improve to approximately 41.7%, compared to 37.3% in 2013. This improvement is expected to result from the positive full year impact of the many supply chain initiatives implemented as part of the turnaround strategy as well as an estimated improved mix of full price product sales. Heavier than anticipated promotional activity in the marketplace could cause gross margins to be less than 41.7%.

- Operating expenses are estimated to be approximately $345 million, compared to $326 million in 2013. The increase in operating expenses is due to a planned increase in investments in tour and marketing, higher variable sales related expenses, and modest cost of living increases.

- Pre-tax income is estimated to range from $15 to $19 million, with a corresponding tax provision of approximately $6.5 million. Pre-tax income in 2013 was a loss of $13.3 million with a corresponding tax provision of $5.6 million.

- Fully diluted earnings per share is estimated to range from $0.12 to $0.16 per share on a base of 78.0 million shares, compared to a 2013 loss per share of $0.31 on 72.8 million shares. If the Company is successful in achieving these results, it would be the Company’s first net profit since 2008 and would represent a significant milestone in the Company’s turnaround story.

Callaway Golf www.callawaygolf.com